April 19, 2024

Good morning and happy Friday. This week, we dig into a newly unveiled stablecoin bill from Senators Lummis and Gillibrand.

Top Points

Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) introduced a comprehensive stablecoin bill that would establish a framework for banks and trust companies to issue stablecoins, set reserve and disclosure requirements, and outline roles for state and federal regulators.

The House Financial Services Committee advanced several bills out of committee by a party-line vote, including the Financial Services Innovation Act, which would allow companies offering innovative financial products or services to operate under tailored regulatory frameworks.

Senator Elizabeth Warren (D-MA) fired off another letter raising illicit finance concerns, this time urging Secretary Yellen to oppose any stablecoin legislation unless it applies AML/CFT requirements "to the entire digital asset ecosystem, including payment intermediaries such as miners and validators."

Lummis-Gillibrand Payment Stablecoin Act

On Wednesday, Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) introduced a comprehensive, revamped stablecoin proposal.

TLDR: The bill provides a pathway for banks and trust companies to issue stablecoins, establishes reserve and disclosure requirements, outlines roles for state and federal regulators, provides a framework for the FDIC to wind down failed issuers, largely bans algorithmic stablecoins, and clarifies that issuers are subject to the Bank Secrecy Act.

Text.

Here's a closer look at key provisions.

Who May Issue Stablecoins?

Permissible issuers would include:

Trust companies chartered by a State bank supervisor AND with an effective registration statement with the Fed (but Fed could deny an application with a 2/3 vote by all Fed Board members). § 6(b).

Cap: A state trust company could only issue up to $10 billion of stablecoins. § 6(a).

Depository institutions (i.e., banks) approved by a State supervisor or the OCC AND authorized by a majority vote of Fed Board members. § 7. (No cap on issuance amount.)

Evaluation Criteria

When determining whether to allow a firm to issue stablecoins, state and federal regulators must evaluate:

An issuer's ability to back reserves on a 1:1 basis;

An issuer's financial resources and managerial or technical expertise, including risk management and compliance procedures;

Potential benefits to the public, including innovation and competition; and

The stability of the U.S. financial system. §§ 6(b); 7(b).

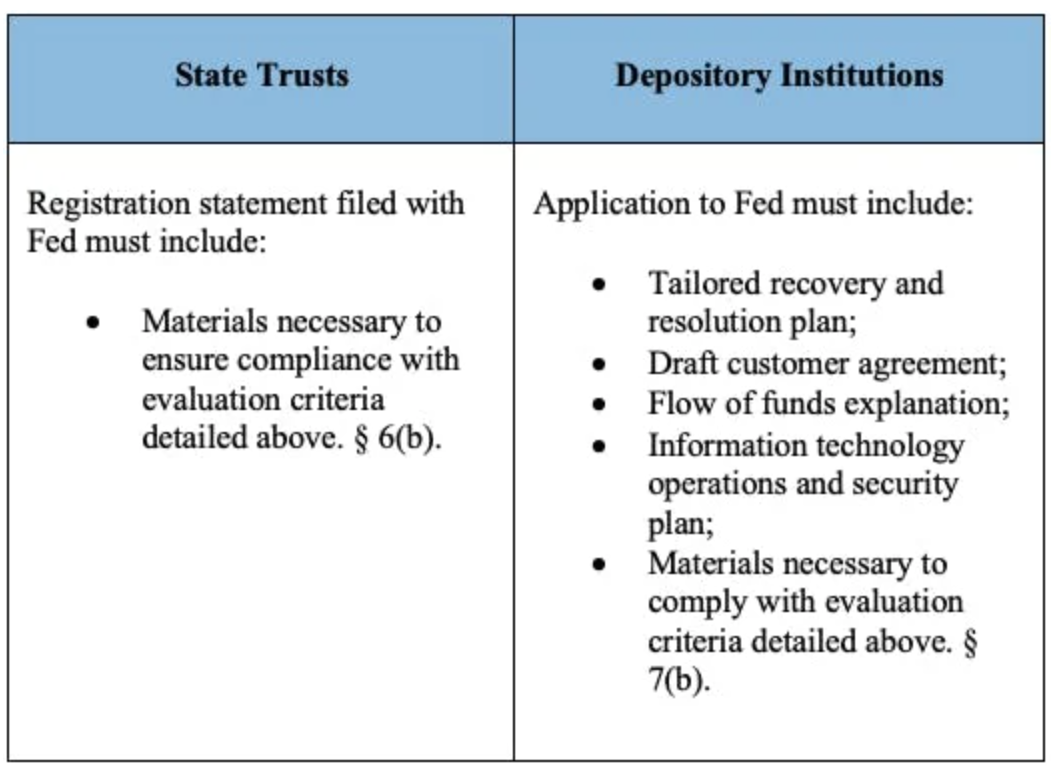

In addition, the bill directs the Fed to write rules regarding what must be submitted to the Board as part of the approval process, though requirements for depository institutions are more proscriptive:

What Rules Apply?

All issuers must:

Back reserves on a 1:1 basis with highly liquid assets.

Reserve assets could include cash, demand deposits (up to FDIC-insured limit), U.S. Treasury bills with a maturity date of 90 days or less, and certain repurchase agreements. Depository institutions could also count balances held at a Federal Reserve bank as reserves.

Publicly disclose summaries of reserve asset information on a monthly basis, and file reports with the Fed about reserve composition, subject to penalty of perjury.

Clearly disclose that stablecoins are NOT guaranteed by the U.S. government and are NOT FDIC- insured.

Satisfy customer redemption requests within 1 business day.

Limit activities to those relating to stablecoin issuance (i.e., by only issuing through limited-purpose subsidiaries).

Comply with Gramm-Leach-Bliley customer privacy requirements.

Be treated as financial institutions under the Bank Secrecy Act.

NOT rehypothecate reserve assets (with limited exceptions). See § 4.

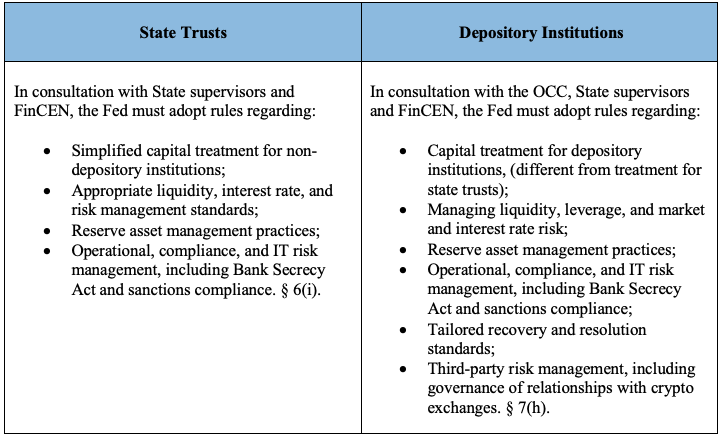

Moreover, the bill directs the Fed to write additional prudential regulations for trusts and depository institutions.

Federal v. State Regulator Supervision & Enforcement

In the case of State trust issuers, the State supervisor has primary supervisory authority, including the power to examine an issuer’s financial and operational condition, safety and soundness, and systems for monitoring risks. § 6(c). State chartered issuers must also file compliance reports with the State supervisor, who must then provide those reports to the Fed. § 6(e). As for enforcement, the Fed and State supervisor must act jointly. See §§ 6(c)-(d); § 11.

For depository institutions, the OCC or State bank supervisor and the Fed would share supervisory and examination authority. § 7(f)(2). The Fed could also unilaterally bring enforcement actions and prohibit an issuer from issuing stablecoins if it determines the issuer is violating the law or operating in an unsafe or unsound manner. § 11.

Other Notable Provisions

Algorithmic Stablecoins Ban: Algorithmic stablecoin issuance would be banned in the U.S., but the Fed must establish limited safe harbors from this ban "consistent with the purposes of this act." § 3(c)-(d).

Custody: Non-depository trust issuers would be the legal custodians of reserve assets, but they must use depository institutions to custody their reserve assets. § 6(g). Anyone providing custodial services must separate customer funds from proprietary assets of the issuer. § 4(b).

SAB 121 Repeal: Section 14 would effectively revoke SAB 121.

Third-Party Service Providers: Third-parties hired by issuers to provide services related to stablecoin issuance would also be subject to Fed supervision and Fed-imposed minimum financial resource requirements. § 4(i).

But note: There's an exemption for self-custody wallet providers.

FDIC Receivership: Taking up the majority of the 179 page bill, Section 9 sets forth a detailed receivership framework for how the FDIC would wind down stablecoin issuers in financial distress (adapted from existing Federal Deposit Insurance Act).

Interoperability: Section 12 directs the OCC, state bank supervisors, and NIST to prescribe standards for issuers and service providers regarding interoperability amongst stablecoin systems and between stablecoin payment systems and other payment systems.

Effective Date: The bill would become effective at the earlier of 18 months after enactment or 90 days after Fed issues final implementation rules and notifies Congress. § 15.

What's Next?

House and Senate leaders will continue working on hashing out differences between Rep. McHenry's Clarity for Payment Stablecoins Act and the new Lummis-Gillibrand proposal, including specifics around the scope of permissible issuers and a state pathway for issuers. For example, in contrast to Lummis-Gillibrand, the House bill would allow for nonbank, non-trust entities to issue stablecoins, does not include a $10 billion cap on state-qualified issuers, and does not include an algorithmic stablecoin ban.

On the bright side for deal prospects, Politico reported this week that Senate Banking Chairman Sherrod Brown is open to a stablecoin package if it includes cannabis banking reform, bank executive accountability reform, and addresses illicit finance and consumer protection concerns.

HFSC Markup

On Wednesday, the House Financial Services Committee marked up a series of bills, including the two summarized below that may be of interest to the crypto community. However, because the bills did not receive Democrat support, this is likely as far as they will go.

H.R. 7440 - Financial Services Innovation Act of 2024 ("FSIA")

Summary:

The FSIA would allow companies working on innovative financial services or products to work with regulators in crafting "alternative compliance strategies" that would allow them to build and operate under tailored regulations. To do so, the company would have to show their innovation would serve the public interest, improve consumer access to finance, promote consumer protection, and not cause systemic financial risk.

The bill would also establish Financial Services Innovation Offices at key federal agencies and a liaison committee to improve coordination and cooperation between government regulators and private sector firms building innovative products and services.

Vote: Passed 28-22 (party line vote).

Text.

H.J. Res. 120

Summary: This resolution would effectively revoke FSOC’s guidance for determining when a nonbank financial company is systemically important, and thus subject to enhanced prudential regulations. At a previous committee hearing, Republicans had raised concerns that FSOC may use its designation authority and recent guidance to end run Congress on financial innovation policy, including digital asset policy.

Vote: Passed 28-22 (party line vote).

Text.

Look Ahead

House and Senate are in recess next week.

Wednesday, May 1 - 12PM - BBQ & Blockchain Briefing: How Should Congress Regulate Crypto?

Hosted by the American Institute for Economic Research, featuring Dr. Thomas Hogan, Caitlin Long, and J.W. Verret, moderated by Grant McCarty.

Where: Rayburn HOB - Room 2043.

RSVP.

Wednesday, May 15 - The Digital Chamber hosts its annual DC Blockchain Summit.

Quick Hits

Congress

Senator Elizabeth Warren (D-MA) sent a letter urging Secretary Yellen to oppose stablecoin legislation unless it "includes the full suite of AML tools," including applying the Bank Secrecy Act to noncustodial wallet providers, miners, validators, and other blockchain network participants.

Letter.

Senators Elizabeth Warren (D-MA) and Chuck Grassley (R-IA) sent a letter to CFTC Chair Rostin Behnam seeking detailed information about his meetings with SBF.

Letter.

At a House Financial Services subcommittee hearing on Ransomware, crypto was not the focus, but Reps. Young Kim (R-CA) and Wiley Nickel (D-NC) asked how law enforcement is using blockchain tracing tools to track funds garnered through ransomware attacks.

Jacqueline Burns Koven, Head of Cyber Threat Intelligence, at Chainalysis, testified:

"While some may suggest that the nature of cryptocurrency facilitates the crime of ransomware, the reality is that its nature facilitates incomparable visibility — on individual transactions as well as the structure of organized criminal networks — and that benefits law enforcement immensely."

Courts

Coinbase is looking to appeal Judge Failla's recent ruling that an investment contract can arise from a transaction that imposes no post-sale obligations.

Filing.

Avi Eisenberg was convicted of fraud and manipulation in a trading scheme involving a decentralized exchange.

Article by Crystal Kim in Axios.

Thank you for reading and enjoy your weekend.

GSL

Warpcast: @caphillcrypto

For bespoke policy research, tracking, and analysis tailored for your project,

learn more about Cap Hill Crypto Advisory Services.

*All information contained in this newsletter is for informational purposes only and should not be considered legal or financial advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The author may own cryptocurrencies discussed herein.*